Why give the government an interest free loan?

Would they do the same for you?

NO!

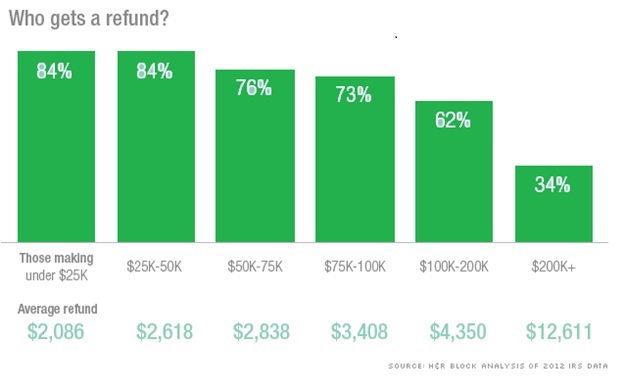

And yet, 8 out of 10 Income Tax filers receive a refund from the IRS.

Source of chart: Money.cnn.com

If you save the $2116.50 each year for the next 10 years and make 8% a year you would have $32,777.36. If you continued this another 10 years $103,877.54. Another 10 years $257,377.49.

$257k would give you $10k per year using the 4% rule.

To figure out what you will owe the Federal government at the end of the year you can go to and look for the TAX TABLES publication for the year in question. As long as you have an idea of how much money you will make during the year you can get a close estimate of your federal tax bill. www.irs.gov

Once you figure out what you will owe at the end of the year you can begin planning. Either you adjust the taxes you are paying or you plan what you will do with the check at the end of the year. Somehow I always end up owing so I like knowing ahead of time how much I need to save to cover the tax bill.

***I am not a Tax Professional. Prior to making any financial changes, you should seek the advice of a Tax professional or read all of the IRS publications pertaining to your circumstance.***

Once again, Thanks for your time!

The Retirement Dude