Why should the “BUDGET” be number one on your list? Because without out one you might not have a clue where all your money is going. Most people who don’t budget end up maxing out credit cards, taking out second mortgages and chasing careers that they don’t enjoy just to keep up with their out of control spending.

Alright Retirement Dude, since we know why we need a BUDGET how do we accomplish setting up this thing you call a BUDGET? Well, one thing to remember is that every dollar you get needs to have a pre-planned place to go whether it be to go to your savings, investments or paying off a debt early.

Ok, let’s get to it!

- Download the spreadsheet I have on the website. (You can remove or add categories to fit your circumstances.)

- Gather a list of ALL of your spending for the past 3 months. (This may be scary but is an important step)

- From your list of spending figure out what is mandatory: food, mortgage/rent, utilities.

- Then add in your next most important items: Insurance, HOA, gas, debt payments.

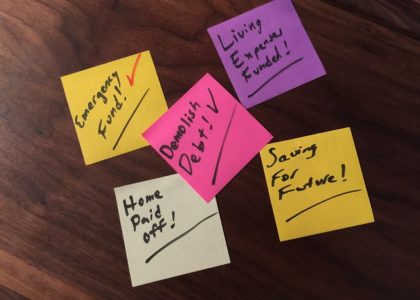

- Next we have savings/investment. This goes here unless you have debt. In the case that you have debt then all of your extra income after lines 3 and 4 should go to this to destroy the debt and give you back control of your life.

- Lastly we have the miscellaneous list: new clothes, dining out, entertainment, cable, internet, gifts, and lastly Tattoo’s. I know how much you think you neeeeed that new tattoo, but you don’t.

Well, there you have it. It’s that easy. Now you know where you stand. It might not be where you want to be standing but with the “BUDGET” ~ crackle of thunder and a few lightning flashes~ you will be able to make a plan to get there.

Thank for reading,

The Retirement Dude